In the last two decades, Registered Unrecognised Political Parties (RUPPs) have grown from 694 in 2001 to 3,264 as of March 2024, taking advantage of loopholes in law and regulatory mechanism over political donations. An RUPP is a political party gets less than a certain percentage of valid votes polled in assembly and Lok Sabha elections.

In Delhi alone there are 238 RUPPs, as per the ECI records, which add up to a total of 3,264 such parties spread across States and Union Territories. Of them, the ECI’s last year data showed 282 of them have been delisted and another 218 are inactive.

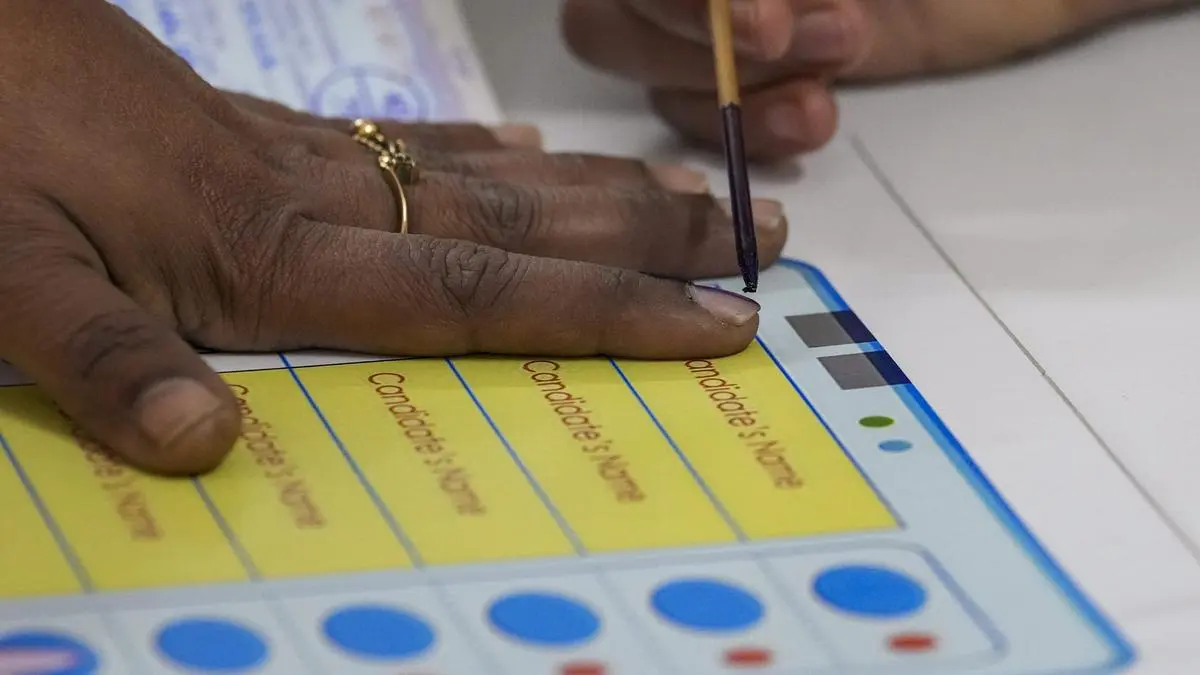

The RUPPs are mandated to submit their contribution reports under section 29C of the Representation of the People Act (RPA), 1951.

Seeking more scrutiny, sources said that, majority of RUPPs do not submit compliance reports to the Chief Electoral Officers (CEOs) of States or the ECI.

There is currently no online portal through which the submitted contribution reports can be accessed and verified against the RUPPs’ Income Tax return filings, sources pointed out.

Sources said the CEOs of States, at times, have been found wanting to regularly update reports and information about more than 16 compliance steps the RUPPs have to follow, possibly due to their insignificant presence in political landscape.

Other than that, there is a need to standardise the format of filling reports and data structure so that it is easier to monitor and regulate political funding at the grassroots level, observed sources.

The ECI did not respond to a detailed questionnaire that businessline had mailed on March 19 to seek responses on issues raised in the reportage.

If a political party fails to furnish its contribution reports before the ECI or files it after the due date of filing the ITR, exemption under Section 13A of the IT Act will be denied to them.

But, it is learnt that there is a lack of infrastructure synergy between the ECI and CBDT as there is no common information sharing pool which could alert the enforcement agency on any discrepancy in filling mandatory records or on non-compliance of it.

Published news reports of IT raids in 2021 and 2022 indicated that donations made to RUPPs were routed through multiple layers of banking channel for siphoning off the money. Sources said the cash is withdrawn to hand over to either donors or others after deduction of some commission in the range of 1 per cent to 3 per cent.

The IT action also unfurled that neither book of accounts nor the bills or vouchers of expenditure claimed, were maintained by these RUPPs.

Tax evasion through RUPPS Route

* Register as political party

* Collect tax exempted donation under IT Act

* Donors claim tax deduction under IT Act

* RUPPs not filling contribution reports

* No mechanism to match donors with donee

Discover more from

Subscribe to get the latest posts sent to your email.

Be the first to comment